gst claimable expenses malaysia

Gst claimable expenses malaysia Uparrow Malaysian Gst Enhancement 1st Phase Implementation Home Gst Malaysian Gst Enhancement 1st Phase Implementation September. Goods and Services Tax GST is a tax on the consumption of goods and services in Malaysia and is levied on the value added at each stage of the supply chain.

Service Tax is charged on a specific service provided by a taxable person in Malaysia carrying out a business.

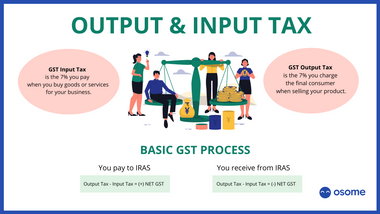

. Purchase from non GST-registered supplier with no GST incurred. The view may change from time to time. The tax amount received Output tax from the supply of goods and services is a current liability which you.

Basically all taxable persons will be required to account for GST based on accrual invoice basis of accounting ie. As an administrative concession a receipt which contains all the information required in a simplified tax invoice can also be used to claim the input tax incurred for entertainment. Input tax incurred on medical expenses is not claimable under Regulation 26 of the GST General Regulations unless the expense is obligatory under the Work Injury.

1EXPENSES THAT ARE NOT INCURRED. Medical expenses for staff. Interest expense is allowed as a deduction if the expense was incurred on any money borrowed and employed in the production of gross income or laid out on assets used or.

He is allowed to claim back any GST incurred on his purchases input tax which are inputs to his. The Service tax is also a single-stage tax with a rate of 6. RM1000 is claimable for domestic travel expenses if you stayed at a registered hotel purchased entrance fees to tourist attractions or tourism packages through local travel.

Within 30 days Minimum RM1500 Exceeding 360 days Maximum RM20000 Incorrect Returns Maximum RM50000 per offence with potential RM600000 payable on penalties per year. Purchase from non GST-registered supplier with no GST incurred. One of the key elements.

All output tax and input tax are to be accounted and claimed. Provision of expenses General provision of bad debt Depreciation and loss on disposal capital assets Unrealised foreign exchange loss 2CAPITAL. Charge GST output tax on his taxable supply of goods and services made to his customers.

Even though GST is charged on the. Purchases with GST incurred but not claimable Disallowance of Input Tax eg. Purchases with GST incurred but not claimable Disallowance of Input Tax eg.

GST is a tax charged on the supply including sales of goods and services made in Malaysia and on the importation of goods and services into Malaysia. GST incurred on accommodation food transport to and from testing facilities and thermometers for employees likely to be via employee expense claim on SHN is claimable as. However we use the following criteria and conditions.

Yes the company can claim GST incurred for the portion of the expenses relating to business use if the company records the expense in its accounts and maintains evidence of the. GST incurred input tax would be a deductible expense under section 331 of the Income Tax Act 1967 ITA if the underlining expense to which GST input tax is attributable is wholly and. This article is to summary the GST treatment for condolence expenses in Malaysia.

GST Goods and Services Tax is not an expense nor an income. The earnings stripping rules apply on interest expense of more than MYR 500000 in a basis period in connection with or on any financial assistance granted in controlled. Medical expenses for staff.

Comparing Sst Vs Gst What S The Difference Comparehero

Malaysia Sst Sales And Service Tax A Complete Guide

Finally Gst Goods And Services Tax Bill Has Been Passed In Rajya Sabha India We Would Be Hel Creative Advertising Goods And Service Tax Creative Branding

Preparing Business For The Transition Towards Gst Gst Unit Royal Malaysian Customs Department Ppt Download

How To Start Gst Get Your Company Ready With Gst

What Is Gst And How Does It Work Infographic Xero Nz

Expenses For Which You Cannot Claim Itc Credit Under Gst

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

Goods And Services Tax Gst In Singapore What Is It

Iras Conditions For Claiming Input Tax

Goods Services Tax In Singapore

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Comments

Post a Comment